Once we hear the word "insurance," what relates to brain? For most, it’s a posh environment crammed with bewildering phrases, good print, and seemingly endless solutions. But at its core, knowing coverage the basic principles is actually about defending what matters most for you: your health and fitness, your home, your profits, and your lifetime. No matter whether you’re a younger Grownup just beginning or anyone seeking to evaluate your coverage, being aware of the basics of insurance plan is crucial.

Think of insurance plan as a security Internet, a way to safeguard on your own from surprising monetary burdens. Daily life has a method of throwing curveballs, and when disaster strikes, insurance policy may also help soften the blow. But how just does it function? To begin with, coverage can be a agreement in between you and a business. You pay them a regular amount of money, generally known as a premium, and in return, they guarantee to address specific charges if a thing goes wrong.

At its most basic, the purpose of insurance policy will be to share the chance. Enable’s say you get into an automobile accident. Instead of paying for many of the damages from pocket, your automobile insurance provider actions in to include most or all of the expenses. In essence, insurance swimming pools resources from many people, encouraging Everyone shoulder the financial stress in instances of want. This idea of shared hazard is the inspiration of just about all insurance plan guidelines.

You will discover various varieties of insurance plan, Every intended to shield diverse elements of your lifetime. Health and fitness insurance plan, such as, aids go over health care costs, when homeowners coverage safeguards your house from damages like fires, floods, or theft. Daily life coverage gives monetary stability for your family from the occasion of one's passing. Vehicle insurance plan, as being the name suggests, handles The prices linked to vehicle incidents or damages towards your auto.

What Does Understanding Insurance The Basics Do?

One of many first items to comprehend is how insurance coverage premiums are calculated. Insurers acquire a lot of aspects into account when determining the amount you’ll pay out each month. For health insurance coverage, they may examine your age, wellbeing historical past, and Life style choices. For car insurance, the make and model of your car, your driving heritage, and in many cases your location all appear into Perform. Rates are primarily the expense of transferring danger from you to your insurance provider, and the more danger you present, the higher your high quality can be.

One of many first items to comprehend is how insurance coverage premiums are calculated. Insurers acquire a lot of aspects into account when determining the amount you’ll pay out each month. For health insurance coverage, they may examine your age, wellbeing historical past, and Life style choices. For car insurance, the make and model of your car, your driving heritage, and in many cases your location all appear into Perform. Rates are primarily the expense of transferring danger from you to your insurance provider, and the more danger you present, the higher your high quality can be.It’s also critical to comprehend deductibles. A deductible is the quantity you must shell out away from pocket right before your insurance policy protection kicks in. One example is, Should you have a overall health coverage strategy that has a $1,000 deductible, you’ll need to pay out the 1st $one,000 of professional medical costs by yourself. Following that, your coverage can help cover supplemental fees. Deductibles can differ dependant upon the style of insurance coverage and the precise policy you choose. Lots of people choose higher deductibles in exchange for decreased premiums, while some like lower deductibles For additional quick protection.

When it comes to insurance coverage, it’s necessary to know the difference between what’s included and what’s not. Not all circumstances are coated by just about every coverage. As an illustration, homeowners insurance coverage usually handles damages from hearth or vandalism, but it won't deal with damages from a flood or an earthquake. If you live in an area at risk of flooding, you might have to have to get further flood coverage. This idea of exclusions—what isn’t covered by a policy—is one of the trickiest areas of insurance policies.

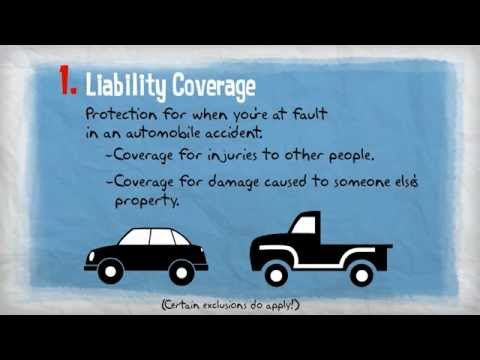

For the people of us who depend on our vehicles for getting from stage A to position B, comprehension auto insurance plan the basics is significant. Car insurance is necessary by legislation for most states, even so the protection it provides could vary greatly. Liability insurance coverage, as an example, addresses damages to Others or property for those who’re at fault in an accident. Collision coverage aids restore or substitute your car or truck if It is really harmed inside a crash, even though complete coverage handles non-collision situations like theft, vandalism, or natural disasters.

But don’t be fooled into thinking that all insurance policy businesses are the exact same. Even though they could offer you related policies, different vendors can have distinct principles, pricing structures, and customer care reputations. It’s important to store all over and Look at insurance policies prior to committing. A few minutes of analysis could preserve you a substantial sum of money in rates or assist you to obtain extra detailed coverage for your preferences.

Enable’s change gears and speak about lifestyle insurance coverage. Daily life insurance coverage isn’t only for older men and women or People with dependents—it’s a important Instrument for anybody wanting to shield their family members fiscally. If some thing ended up to happen to you, existence coverage provides a lump-sum payment towards your beneficiaries. This could certainly aid include funeral expenses, debts, and day to day residing expenditures. There are two key varieties of existence insurance: term and lasting. Phrase life insurance policy addresses you for a selected period, when lasting life insurance policy offers lifelong protection and may even accumulate money benefit eventually.

When contemplating lifetime insurance policy, consider what would happen for those who have been no longer close to. Would your family be capable to shell out the property finance loan or afford to pay for to mail the kids to varsity? Would they struggle with working day-to-working day residing costs? By possessing lifestyle insurance, you’re ensuring that your family received’t be still left with economic hardship during the experience of an already emotional and tough predicament.

Among the most generally forgotten types of coverage is disability insurance policies. In case you turn into unable to perform because of health issues or injury, disability insurance policies offers a part of your profits to help you keep you afloat. It’s very easy to presume that it won’t transpire to us, but the truth is the fact that mishaps and diseases can strike everyone Anytime. Obtaining disability coverage makes sure that you won’t be financially devastated For anyone who is struggling to work for an prolonged period of time.

Comprehension the basic principles of insurance coverage can seem to be mind-boggling at the beginning, but once you split it down, it’s much easier to see the bigger image. The primary objective of coverage is to provide you with satisfaction. By understanding that you've got protection in position, it is possible to Are living your lifetime with a lot less worry on the unidentified. It’s about currently being well prepared for your unexpected and understanding that there’s a security net to capture you if you drop.